When I retired I put my savings into the stock market. I discovered putting together a retirement portfolio in neither difficult nor all that risky. This is a classic buy and hold portfolio that rides out bear markets with grace.

The first stocks I purchased were bank stocks. The Royal is Canada's largest bank. Today it is paying dividend of $5.28 for a yield of 4%. TD and the Bank of Montreal are two other must-haves when it comes to Canadian banks. TD pays a dividend of $3.84 for a dividend yield of 4.4%. BMO is paying $5.72 for a yield of 4.5%.

- BMO - 4.5% dividend yield

- CM - 6% dividend yield

- RY - 4% dividend yield

- TD - 4.4% dividend yield

One Canadian bank down on its luck is CIBC. Its depressed share price translates into a 6% dividend yield from a dividend of $3.40. Hold these four banks and you have checked off the financial holdings in your portfolio. Note: These Canadian banks are famous for not cutting their dividends. Invest $60,000 divided equally among these four bank stocks and you can count on about $2835 annually in dividend income.

Next, I would turn to the utilities sector and put about 15% of my retirement savings in a mix of Emera, Fortis, Hydro and possibly a little in Alta Gas. I think of Alta Gas as more of a utility than a pipeline.

- Emera - 5.3% dividend yield

- Fortis - 4.1% dividend yield

- Hydro - 3% dividend yield

- Alta Gas - 6% dividend yield

Put $30,000 into these four utility stocks, 4% in all but Hydro, which get 3%, and you can count on about $1410 annually in dividend income.

Pipelines are another solid investment paying fine dividends. All retirees have money invested in pipelines even if they do not know it. The Canadian Pension Fund, CPP, has a large exposure to pipelines. Buy Enbridge (ENB), TC Energy (TRP) and Pembina (PPL) and you have three good, solid companies. Note the generous dividends. There is a good reason the CPP likes pipelines: the dividends.

- Enbridge - 6.5% dividend yield

- Pembina - 5.7% dividend yield

- TC Energy - 6.6% dividend yield

Put $30,000 divided equally among these three pipeline stocks and you can count on about $1880 annually in dividend income.

This brings us to telecoms. One simply must have exposure to this segment of the market and there are lots of good companies in which to park some retirement money. Think Bell, Cogeco, Quebecor and Telus.

- Bell - 6% dividend yield

- Cogeco - 4.4% dividend yield

- Quebecor - 3.8% dividend yield

- Telus - 5.2% dividend yield

Divide $40,000 equally among these four telecom stocks and you can count on about $1940 annually in dividend income.

With only a $160,000 invested, our retirement income portfolio is already generating more than $8000 a year. It is a rare retired couple who have not saved at least $160,000 toward their retirement. The present portfolio contains fifteen different companies. This is approaching what many claim is the ideal number of investments for a small portfolio.

If our retirees have a bit more to invest, it is time to consider putting a little into the American market. It is, after all, the biggest game in the world. A couple of American-based ETFs does not seem unreasonable. I'd put $40,000 into the States with 66% in ZWA, the BMO Covered Call Dow Jones Industrial Average Hedged to Cdn. Funds ETF, and 34% in XUS, the iShares Core S&P 500 Index ETF. (The ZWA is here for the dividend. Seniors need income. If you do not need the income, put more into XUS.)

- XUS - 1.4% dividend yield

- ZWA - 6% dividend yield

Invest $40,000 divided as detailed in these two ETFs and it should generate about $1775.

Not having anything invested outside North America would be seen by some as a basic error in building a properly diversified portfolio. I am not one of these folk but if you are I would think of adding an ETF like VIDY to the mix. A Vanguard ETF, VIDY has a very low MER and pays a nice dividend of 4.35%.

If I had $25,000 I'd add some VIDY and increase my income by $1085 annually.

- VIDY - 4.35% dividend yield

At this point, I just might call it quits. I could add some health care but the stuff I would buy does not deliver the dividend income I need in retirement. And what do I like in health care? Think TDOC and XHC.

Every portfolio I have ever had contained something that was there just for fun, to provide some excitement. I wouldn't add a lot of the following but I would be comfortable putting $25,000 in my portfolio split evenly between BN, Brookfield Corporation, and BAM, Brookfield Asset Management.

- BAM - 3% (estimated) dividend yield

- BN - 1.4% dividend yield

Brookfield is a fine holding in any portfolio. BAM, a recent spin-off, promises to pay a good, if not great, dividend. BN has a posted dividend yield of 1.4%. My hope is that the Brookfield investment will deliver excellent capital gains along with a fair dividend to pay one for holding the stocks.

There, we are done. A quarter of a million invested and an income of approximately $11,400. That's close to a thousand dollars a month. This portfolio delivers the almost mythical four percent without breaking a sweat.

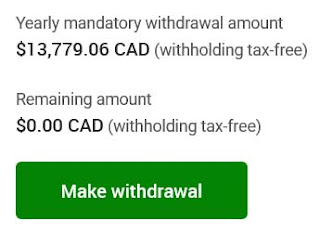

If one does not already have a TFSA, tax free savings account, I'd get one. Putting as much of this investment as possible into a TFSA makes a lot of sense. Avoiding some taxes makes a dividend income in retirement go farther.