We meet the mandatory withdrawal requirements of our RIFs not by withdrawing cash but transferring equities. This is called making an in-kind withdrawal.

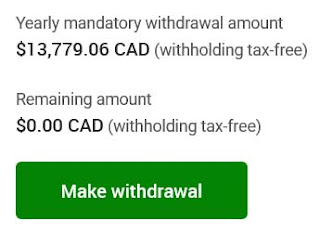

TD WebBroker posts your mandatory withdrawal amount. Simply click the tab labelled "RRIF Payments". Although there is no withholding tax, tax must be paid in the year following the withdrawal.

To make a withdrawal in-kind, to transfer equities from your RIF to either a TFSA (tax free savings account) or a non-registered account, you must call TD WebBroker and speak with a representative authorized to buy, sell and transfer equities.

Let's say you own a thousand shares of Enbridge (ENB) in your RIF. You ask the representative to transfer enough ENB shares to match your mandatory withdrawal amount as closely as possible. They check the market, find the stock is selling for $50 at the moment and divide your posted mandatory withdrawal ($13,779.06) by the price of the stock. The representative transfers 275 shares worth $13,750. There is no commission charged as no stock is bought or sold. The remaining balance of $29.06 is transferred as cash from the RIF to the TFSA.

If you are transferring stock and cash to a TFSA, you must ensure you have adequate headroom to accept the transfer. TFSA headroom is the sum of three amounts:

- deposit headroom remaining unused from last year

- the total dollar amount withdrawn from the TFSA last year. Funds withdrawn from a TFSA cannot be replaced in the year the funds were withdrawn. One must wait until the following calendar year to be able to replace the funds.

- the annual TFSA dollar limit. This has been increased to $6500 for 2023.

If the sum of these amounts is not large enough to accept the total transfer, the remaining balance can be moved to a non-registered account.

One nice perk provided by this approach is that the dividend income from the stock held in one's TFSA is tax free. Today, ENB is paying a dividend of $3.548 CAD annually or 6.52% based on Friday's closing stock price. The 275 shares transferred in the example would pay $975.70 annually and no tax to pay!

The annual withdrawal amount is based on your age and a percentage of the value of your RRIF -- a percentage that increases with each passing year. There tables detailing the percentage that must be withdrawn annually from both LIFs and RIFs.

Here is a link to the table posted by the University of British Columbia. Note, as the UBC post makes clear, the maximum withdrawal amount in BC for a LIF may be higher than the maximum quoted in

the tables. It can be equal to the investment return earned by your

LIF in the previous calendar year. Mawer also discusses this in a post: 2022 LIF withdrawals: What you need to know.

Unlike LIFs, there is no maximum withdrawal limit for RIFs but one is wise to think carefully before withdrawing too generously.

With TD Direct Investing clients must contact WebBroker to make an in-kind withdrawal or transfer. If making a cash withdrawal, simply click the green "Make withdrawal" button. I always have a minimum withholding tax of 30% applied. Sometimes, I even have 35% withheld. I find this is necessary as no tax is withheld from the in-kind withdrawal. I do not want to learn I had too little tax withheld and now must pony up cash to cover an unexpected tax bill.

When making an RIFwithdrawal, always have all relevant information available:

- RIF account number

- amount of mandatory withdrawal

- name and symbol of stock to be transferred

- TFSA account number

- TFSA contribution headroom available (Check this carefully. Do not over-contribute.)

- Non-registered account number

- I do all the math in advance. This is important. The bank reps are busy. Mistakes happen.

The nice thing about the market being down at the moment is that we can move more stock to our TFSA and then it sits producing a tax free stream of dividend income and, if we are lucky, eventually a nice capital gain as well.